Wednesday, May 26, 2010

Lion Brewery (LION) Net earnings of LKR596.8 mn in FY2010 (Vs LKR45.1 mn in FY2009)

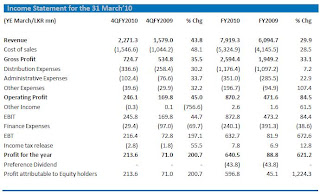

Lion Brewery (Ceylon) PLC [LION:LKR105] has exhibited an impressive performance to conclude FY2010 where net earnings grew to LKR596.8 mn from LKR45.1 mn in FY2009. The bottom line of 4QFY10 grew by two fold YoY to LKR213.6 mn (recording a QoQ growth of 12.5%).

LION, the 50.4% owned subsidiary of Ceylon Brewery [BREW: LKR176.00], is by far Sri Lanka's dominant manufacturer and marketer of the highly popular 'Lion' brands of beer as well as 'Carlsberg '(under the license of the Danish Brewer- Carlsberg International). LION plays a near monopoly (85% share) in the local soft alcohol market), has grown reasonably strong by a CAGR of 3.6% over the past three years despite the difficult economic and security conditions.

A glance at the yearly & quarterly performance

Revenue up 29.9% YoY to LKR7,919.3 mn in FY2010. LION’s top line has grown strongly by 29.9% YoY during FY2010 and the same for 4QFY2010 is up by 43.8% YoY to LKR2,271.3 mn. The top line growth during the quarter was backed by the freely accessible markets in the north and east provinces blended with the parliamentary elections during the period. FY2010 volume levels have grown in consequent to the new opportunities presented from the expanded market, where LION continues to dominate 86% of the 13% extended population of Sri Lankan in the war torn regions.

The exports sales volume (only constitutes 2% of LION’s revenue) saw a growth of 26% YoY averaging around 17 containers being exported every month. Due to the increasing demand for beer, the management has set expansion plans targeting to increase their capacity. Gross profit margins remain stagnant with just a slight move from 32% in FY2009 to 32.8% in FY2010 in consequent to LION’s focus on its procurement policies.

Operating costs recorded an unparalleled increase of just 16.7% YoY in FY2010. The Company’s operating costs have increased by 16.7% YoY in FY2010 to LKR1,724.2 mn mainly reflecting the inflationary pressure witnessed 1H2009. LION has also benefited from its efficiency programmes in order to utilize the emerging demand so as not to leave a gap in supply by LION for its competitors. This was evident with the improved working capital ratios reported in FY2010. Also, a saving of LKR26.2 mn QoQ has been made during 4QFY2010 in operating costs.

Operating profits recorded a leap of 84.5% YoY in FY2010. The company’s operating profits have increased by 84.5% YoY to LKR870.2 mn during FY2010 whilst 4QFY2010 saw a 45% YoY growth. Distribution costs increased by 5% YoY in FY2010 as the company worked on improving the distribution channels in the previously war torn region with over 100 outlets in those zones. The company continued to upgrade its oulets wilst spending on promotions within the clubs.

Administration costs rose by 22.9% YoY in FY2010 owing to a write off of obsolete and slow moving goods carried worth LKR90.8 mn. Meanwhile other operating expenses have moved up a near 107.4% YoY during the financial year though 4QFY2010 reported a seven fold dip YoY to a minute outflow of LKR0.3 mn. LION’s EBIT grew by a sound 84.4% YoY to LKR872.8 mn in FY2010 with 4QFY2010 reporting a 44.7% YoY growth to LKR245.8 mn.

Pre tax profits heaved to LKR632.7 mn in FY2010. LION has posted a pre tax profit of LKR632.7 mn in FY2010 from a mere LKR81.9 mn a year ago to demonstrate a near seven fold growth. Finance expenses have dipped by 38.6% YoY to LKR240.1 mn in FY2010. This was as a result of the improved gearing level from 53% in FY2009 to 16% in FY2010 coupled with the reduced lending rates prevailing in the wider economy.

The 3:5 right issue announced in 2009 enabled LION to reduce its interest bearing borrowings, which arose mainly as a result of LION’s investment in India, to approximately LKR375.5 mn from LKR1,799.8 mn in the comparative year.

LION’s astounding performance in FY2010 led it to report LKR596.8 mn in net earnings (versus a mere LKR45.1 in FY2009). Backed by the domestic market expanding, increased entertainment activities coupled with the even higher seasonal festive demand and local tourist contribution, LION has recorded a net profit of LKR596.8 mn (Versus a profit of LKR45.1 mn in FY2009) with a near two fold leap YoY in 4QFY10 net earnings to LKR213.6 mn.

Future outlook

With the end of the civil conflict, blended with market penetration and product development (Eg: SKV canned beer) strategies of LION coupled with the positive macro economic outlay, LION has proved to have had a sturdy impact. Hence, LION’s future performance would be signifcantly influenced by the macro economic situation of the country on the back of improved take home pays of the citizens, tourist influx and the overall recreation activity level in the country. We believe with the expected improvements in the economy, a shift from the illicit segment ( which currently constitutes around 60% of Sri Lanka’s alcohol market) to the legal segment, allowing LION to further utilize the outlay.

Despite the prevailing dark environment for alcohol in the country, the alcohol volumes have continuously grown. As per the recent economic indicators issued by the Central Bank, the liquor volume index for the month of February 2010 is at 166.7 whilst recording a 163.8 in the comparative year. Having great potential in the domestic market with the expected rise in disposable income, LION already has its expansion strategies in play.

LION venturing into the vast Indian market with Carlsberg (in which it has an effective holding of 22.5% with the value of the investment at LKR1,447.4 mn as at 31.03.2010) has exhibited uninterrupted growth since their initial footing. We believe this investment to hold great potential in the medium- long run. The development of their green field brewery in Medak - Andhra Pradesh to serve the South Indian market is targeted to start production by end 2010. As the nature of this investment which thrives to serve the vast geographical market whilst establishing breweries in each of the states, we believe it to have a prolonged pay back though capital gains can be expected in years to come.

Forecast FY11E earnings is revised up to LKR965.5 mn. Based on their exceptional performance during FY2010, we revised up our forecast net profit conservatively to LKR965.5 mn (up by 62.7% YoY) in FY11E after taking into account LION’s expansion strategies and the vast beer market’s potential steered by the forecasted tourist arrivals as well the expiration of the 12 year tax exemption for LION. We believe LION to report LKR1,196.9 mn (up by 24% YoY) in FY12E.

Share is valued on 8.7X forecast FY11E earnings. Having hit a low of LKR42.75 in January 2009, LION’s share price has risen strongly by 145.6% as at today. Following this gain, LION trades at 8.7X projected FY11E net profit whilst on a PER of 7.0X FY12E forecasted profit. Given the expected strong growth in demand for soft alcohol/beer, the company’s near monopoly status, likely gains from the venture into India, we maintain BUY

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment