Thursday, July 8, 2010

Chemical Industries (CIC) : FY10 earnings driven by agriculture sector

Originally set-up as a Trading House for ICI - UK, Chemical Industries Colombo (CIC) has pursued a policy of planned growth which has resulted in its diversification into a number of fields over the years. The company grew into agriculture, paints, pharmaceuticals, industrial raw material and packaging dwarfing the chemical business.

CIC Agri Businesses, the biggest contributor in terms of revenue and earnings to the group (near 70%), comprises of companies that provide inputs to the agricultural sector. The construction sector is effectively CIC's paints and surface coatings business (includes the flagship brand Dulux) which is under the group's associate Akzo Nobel Paints Lanka. CIC's quoted subsidiary Chemanex is a manufacturer and marketer of chemicals and industrial intermediates. The pharmaceutical business markets products from principals like Johnson & Johnson, Hilton Pharma and Solvay Pharmaceuticals and sells products from prescription drugs to diagnostic equipment to hospitals.

CIC reported a 47.4% YoY growth in net earnings to LKR600.9 mn during FY10 (greatly inline with our forecast of LKR583 mn) driven by the strong performance in 2HFY10.

CIC's FY10 profits have been driven predominantly by the key agriculture and livestock sector (EBIT up 50%YoY) coupled with 17.8%YoY increase in other income and improved contribution from the industrial raw material sector (EBITT up 92.4% YoY).

The consumer and pharmaceutical sector has weathered a challenging period where the EBIT contribution dipped 10.5% YoY whilst construction sector and packaging segments recorded healthy results to post 7.6% YoY and 12.3%YoY growth respectively during the year.

Quarterly performance at a glance

CIC's turnover grew by a modest 5.9% YoY to post LKR16,610.5 mn in FY10, driven by higher turnover in the key agriculture and livestock segment (up 7.5% YoY) mainly due to improved performance in the seed and livestock business. The paints segment (inputs to associate Akzo Nobel Paints Lanka) saw the top line dipping (down 21.4% YoY) due to the poor performance in 1HFY10 despite the previously cash strapped consumers gradually willing to spend on non essentials during 2HFY10. Revenue from consumer and pharmaceutical segment has grown by 11.4% YoY whilst that of industrial raw material grew by a mere 2.3% YoY due to the global economic downturn where demand for paints related raw materials, rubber and textile binder related materials was still sluggish. The packaging sector remained flat (up 0.5% YoY) signalling the improvement in the previously deteriorating market conditions.

Cost of sales (up 5.4% YoY to LKR13,247.1 mn) has also increased inline with the rise in turnover levels whilst Gross Profit increased by 8.0% YoY to LKR3,363.4 mn. Further, the gross margins have improved marginally to 20.2% in FY10 (vs 19.8% in FY09) due to the group’s efforts on retooling the value chain and efficient business model. With the turnaround seen in 3QFY10 after a poor first half the 4QFY10 too has shown improvement where the revenue has grown 6.2% YoY during the quarter whilst the gross profit has grown 12.4% to LKR893.2 mn

Consequently, despite a rise in administration expenses by 6.5% YoY to LKR1,301.4mn and distribution costs by 11.2% YoY to LKR997.8 mn, operating profit grew by an impressive 27% YoY to LKR1,060.9 mn mainly on the back of the foreign currency translation loss of LKR160 mn incurred in FY09. CIC’s main operational counters witnessed a significant growth in operating earnings where operating profit from the Agriculture segment grew 41.9% YoY to LKR740.6 mn whilst the Packaging sector posted LKR79.1 mn, up 12.3% YoY. The Industrial raw material sector grew by 92.4% YoY to LKR52.0 mn and Construction sector grew by 7.6% YoY to LKR58.3 mn whilst the Consumer and Pharmaceutical sector EBIT dipped 10.5% YoY to LKR215.6 mn despite the sector revenue growing by 11.4% YoY. This is mainly on the back of the pending commissions receivables in food trading.

The Other income has grown to LKR484.9 mn vs LKR411.5 mn posted in FY09 (includes the capital gains from the disposal of Commercial Leasing and Dev-Fern Ltd) mainly due to LKR250 mn released by the government as subsidy payments for Fertilizer sales during November’08 - March’09.

CIC’s share of profit from associates has dipped 19.6% YoY to LKR212.6 mn in FY10 on the back of the dip in profitability of paints sector (Akzo Nobel Paints Lanka). Overall, CIC’s EBIT has witnessed a growth of 16.4% YoY to reach LKR1,758.5 mn in FY10.

Finance cost during the year dipped by 8.6%YoY to LKR671.8 mn mainly on the back of dip in interest rates. Subsequently, the Profit Before Tax has increased by 39.9% YoY to LKR1,086.6 mn in FY10. FY10 net earnings have reported a sharp 47.4% YoY increase to reach LKR600.9 mn where net margins are at 3.6% in FY10 compared to 2.6% in FY09.

Agri business to propel growth?

CIC Agri Businesses, the biggest contributor in terms of revenue and earnings to the group (circa 70%), weathered a challenging first half where the off take in crops was slow however with improved sales and receipt of pending subsidy payments in 2HFY10 the sector contributed positively in FY10. Looking ahead, revival in agriculture is expected to propel earnings growth in the future. Whilst agribusiness remains the company’s key sector, CIC has acted to diverse its agri-revenue streams thereby reducing exposure to weather shocks. CIC is positioned to successfully reap benefits from the changing macro environment of the country where we believe the company is to benefit significantly from an anticipated revival in the agribusiness sector specially stemming from the previously war torn North. CIC has already made its business move into the Eastern province with two large dairy farms. However, venturing in the dry zone is taking more time to break even than expected. But we believe with CIC’s efforts to manufacture for leading brands or developing their own brands would take at least another two years to breakeven. The expansion projects in the sector (banana export project in the Eastern Province, 2,200 acre large scale dairy complex at Mutuwalla in East, Rice exports, etc) would be an added bonus, once the benefits materialize.

Further, forward integration into food retail is also on the cards for CIC however according to the company nothing concrete has been tabled. With the much anticipated economic integration of the previously war affected North & East and the untapped potential in these areas along with an extension to its out grower network we believe CIC agri business is prime to benefit in future.

The Construction business is effectively CIC’s paints and surface coatings business which comes under the group’s associate company Akzo Nobel Paints. CIC is into decorative, vehicle refinishing and industrial paints segments where 80% of the revenue comes from the decorative sector. CIC has a near 40% market share with paints under the brand names such as Dulux and Glidden targeting different income levels. The paints and coatings business had a turbulent period with circa 5% to 10% volume dip due to harsh market conditions. However, once fresh investments, rehabilitation activities and infrastructure developments commence in the North and East there would be an enormous scope for growth.

The Consumer & Pharmaceutical and Industrial Raw Material businesses are also expected to witness a turnaround in FY11 with improved global economic environment.

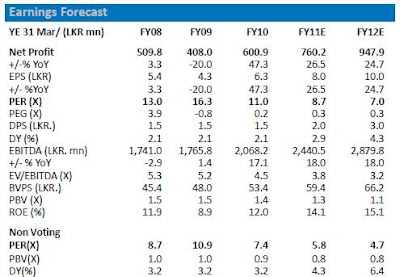

Forecast FY11E net profit to rise 26.5% YoY to LKR760.2 mn. On the back of improving economic conditions, benefits from the North& East and anticipated payoffs from the new projects especially in the food trading, industrial raw material and seed business we forecast CIC to post LKR760.2 mn (up 26.5% YoY) in FY11E and LKR947.9 mn (up 24.7% YoY) in FY12E.

The voting counter has gained 14.4% YTD whilst the non-voting counter has gained 17.3% YTD against a market gain of 25.2%. Following the end of the three decade old war (18th May 2009) the broader market gained an impressive 95.3% whilst CIC (voting) has gained 87% and CIC (non voting) has gained 74.3%.

The voting counter trades at 8.7x FY11E earnings (7.0x FY12E) and the non-voting counter trades at 5.8x FY12E earnings (4.7x FY12E) whilst trading at discount to market.

We believe domestic growth would be observed from the vast potential in the North & East especially in the agriculture and paints sectors where CIC is positioned to successfully reap benefits. On the back of prospects of steady growth (through company’s strategy of balancing the business portfolio between agriculture and non agriculture segments) along with growth stemming from agriculture in the long term and untapped potential in the North & East, we believe both the voting and non voting counters still offer substantial value.

However, CIC’s vast exposure to agriculture and especially fertilizer business makes the company’s quarterly performance unstable. We believe the heavy rains during the first two months of 1QFY11 (however according to the company there has not been a notable reduction in sales so far) and the still to recover paints business could have an impact on the first quarter performance. Despite the short term vulnerability in earnings due to the potential in the long term and attractive earnings multiples we rate CIC a Long Term BUY.

Subscribe to:

Post Comments (Atom)

1 comments:

Informative post! The red lead manufacturers are indeed playing a key role in supporting the battery and paint industries worldwide.

Post a Comment