Sri Lanka’s banking and financial services sector has been a steady contributor to the economy (10.3% to the GDP in 2009) and been one of the most sought after sectors in the Colombo bourse (that gained nearly 110% in terms of market capitalization and sector index gained near 124% during the year 2009). Going forward with the favorable economic outlook, growth potential of banks due to healthy capitalization levels and improving asset quality in the banking sector we see the sector performing above expectations in the coming years.

SEYB which was a one of the major player in the retail banking industry in the past is now showing signs of recovery after its set back in 2008 due to a run on the bank as a result of depositors losing confidence in the bank.

Deposits recoded a marginal 1.5% growth in 1H2010. Bank showing signs of recovering its lost deposits during 1H2010 where it recorded marginal growth after its steep decline in 2008. Further it is also encouraging to see a shift in the deposit mix more towards low cost current and savings (CASA) products. We believe SEYB would return to normalcy during the next 2 years recovering its deposits which would help them to grow from there onwards.

Improvement in non performing loans (NPLs) during 1H2010. NPL’s in 2009 peaked up to near LKR30.0 bn whilst the gross NPL ratio for 2009 stood at 29.3% (which was the highest in the industry). However with the emphasis on recovering the bad loans under new management we saw a reduction in NPL’s in 1H2010 which stood at LKR27.5 bn with the gross NPL ratio still being the highest in the industry at 25.6% (industry NPL ratio is circa 8%).

Healthy interest margins and capitalization levels. SEYB has always maintained its interest margins par with the sector due to its retail focus and differentiated service levels where the banks current interest margins stands at 5.5%. Further bank is also comfortably capitalized with in regulatory limits where the bank does not need to raise capital for its expansions in the near future.

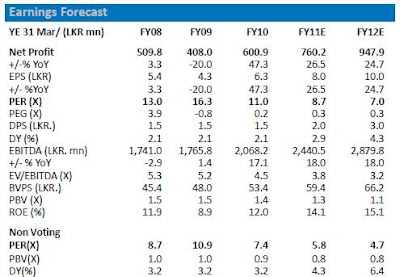

Forecast 2010E earnings to rise by 78% YoY to LKR1,010.9 mn. With banks promising recovery process as stated above coupled with necessary measures to curtail cost and improve its core business activities we also believe SEYB would be in a position to benefit from the expected industry wide upside with strong macro economic position of the country. Based on these assumptions we are expecting a 78% YoY increase in projected 2010E earnings to LKR1,010.9 mn and projected 2011E earnings to rise by 30% to LKR1,316.3 mn.

Non voting share offers good value on 10.9x forecasted 2010E earnings. The non voting share which is trading at a near 44% discount to the voting share offers good value on 10.9x (compared to the sector PE of 13.8x) forecasted 2010E earnings and is attractive at 8.4x forecasted 2011E earnings whilst trading on 1.0x PBV. Given the above assumptions on recovery and industry wide upside we rate SEYB (Non Voting) a BUY.

The voting share is trading near 50% premium to the financial sector, However we believe given SEYB’s branch network and reach and the recovery in its core business coupled with the reviving macro economy and growth potential in the banking sector SEYB has further upside, hence we rate SEYB (Voting share) a HOLD.

Overview

Banking sector overview

Sri Lanka’s banking and financial services sector has been a steady contributor to the economy (10.3% to the GDP in 2009) and been one of the most sought after sectors in the Colombo bourse (that gained nearly 110% in terms of market capitalization and sector index gained near 124% during the year 2009). We saw the asset quality in the banking sector deteriorating in the recent past due to high interest rates and inflationary environment coupled with the weakening macro environment both globally and locally, despite the healthy capital adequacy levels that the banks maintained throughout.

Nevertheless, with the improving macro economic outlook for Sri Lanka and easing interest rates and inflation we expect the banking sector to be a prime beneficiary of this positive momentum. Further we expect that with the end of the 3 decade long seperatist conflict which has opened up a vast cash rich area will provide ample opportunities for banks to grow in the coming years.

Lower lending rates coupled with vast development projects which are underway in the island will enable the banks to grow their loan portfolios. Further with North and East integrated into the economy we foresee branch network of the banks expanding (near 35 new branches were opened after May 2009) and we can expect a growth in their deposit portfolios. In addition, the local banking industry is highly regulated and the issuance of new banking licenses in virtually a non-sorter as Central Bank of Sri Lanka (CBSL) discourages new entrants where we already have circa 23 players (both local and foreign). This provides the existing operators to enjoy the benefits of this upside. Going forward with the favorable economic outlook, growth potential of banks due to healthy capitalization levels and improving asset quality in the banking sector we see the sector performing above expectations in the coming years.

Company overview

Seylan Bank was incorporated in 1987 and obtained a listing for its ordinary shares on the Colombo bourse in 1989. Today the bank stands as the 4th largest private commercial bank in Sri Lanka with an asset base of LKR142.9 bn whilst operating an island wide branch network of 94.

From the inception the bank was more focus on the retail sector offering differentiated (5% bonus on interest reinvested in fixed deposits, 1% bonus interest on minimum balances of savings accounts) and customer oriented services (extended weekday banking hours as well as Saturday banking). SEYB enjoyed immediate success reporting an after tax profit of LKR11.3 mn in 1988 where the profitability has grown at a 19 year CAGR of 26% from 1988-2007. In 2008 bank faced a confidence crisis where customers were demanding for withdrawals due banks associates with Ceylinco group (held near 24%) and the SEYB recorded a loss of LKR143.0 in 2008. Today the bank is recovering from the crisis situation under the new management and the bank has potential for upside (along with the expected industry upside) given the bank will return to its normal operating levels by end of 2010.

The chain of events that happened in year 2008 led to the historic run on SEYB in late 2008 due to failure of financial institutions and loss public confidence in September 2008 an unlisted finance company “Sakvithi Investments” defrauded a near LKR900 mn worth of deposits (individual responsible for the fraud fled the country) after luring exceptionally high rates of returns.

With the instability and fear created by these unregistered finance companies made depositors demand back their funds at Golden Key (which was offering higher rates of 24-30% p.a.) a Ceylinco owned company. Finally all these incidents led to collapse of Golden Key and directors were sued for management malfunction.

Subsequent to the Golden Key crisis there was a run on SEYB where, by then the Ceylinco group (was the holding company of Golden Key) held 24% of the bank and Dr. Lalith Kotelawala who was the chairman of Ceylinco group was also the chairman/managing director of SEYB by that time.

Further bank also had reckless related party lending to most of the Ceylinco group companies which brought about huge NPL’s (peaked up to LKR30 bn in 2008) from Ceylinco group companies after most of them collapsed.

Recovery process under new management

In December 2008 Ceylinco group divested its interest in SEYB where two state institutions (Sri Lanka Insurance Corporation and Bank of Ceylon) bought 25% of SEYB becoming the largest shareholder as at 31st December 2009. Following the take over, CBSL handed over the management of SEYB to Bank of Ceylon and was asked to appoint a new board in the meantime. Decisive action by CBSL to restore SEYB from its crisis was commendable and it also protected the entire financial services sector from further crisis. Under the new management the main priority was to restore public confidence and adopt appropriate risk management strategies.

Future outlook

During latter part of 2009 and 1Q2010 SEYB showed signs of recovery where they were able to bring down the NPL's (from a high of LKR31 bn in 2009 to near LKR27 bn by 1Q2010), curtail costs (near 20% YoY reduction in 2009), improve capital adequacy, strengthen liquidity position (stood at 29% end of 2009 compared to regulatory limit of 20%), improve net interest income and increase foreign remittances.

The bank drew up a 3 year strategic plan from 2009-2011 emphasizing to improve seven key performance indicators such as ROE, NPL ratio, cost to income ratio, profit after tax etc. Further the bank also has taken necessary steps to attract deposits, improve recoveries and managing its business risks. It is also noteworthy that with all these healing processes the bank is also looking at expansion plans for growth mainly in North and East.

Deposits

SEYB’s deposits recorded a steady growth during 2002-2004 where it saw a sizeable leap in 2005 but from 2005 onwards growth in customer deposits slowed down. Banks deposit base dropped considerably in 2008 mainly on the back of global financial turmoil and high inflationary situation in the country. However after 2008 the banking sector deposit growth recovered with declining inflation and recovery in the global crisis (9% YoY growth) in contrast SEYB recorded negative growth mainly because of the internal crisis (Ceylinco group crisis) the bank under went during 2H2008 and early 2009. With the new management in place and sound credit policies adopted the bank has been able build up the confidence of the customer where it has helped to attract the lost deposits to the bank (deposits recoded a marginal 1.5% growth in 1H2010).

Therefore going forward with the improving macro economic conditions and the upside in the banking sector we believe SEYB would be able to recover its lost deposits and will return to normalcy during the next 2 years which would help them to grow from there onwards.

Another positive sign we are seeing the banking sector is the shift in the deposit mix towards low cost CASA products. This is evident in SEYB as well where they have been able to grow its savings products whilst reducing the dependence on high cost time deposits. In 2008, 64% of SEYB’s total deposits came from time deposits where as the contribution from CASA was 36% which was mainly due to high interest rates prevailed at that time. But during 1H2010 saw a 42% contribution from CASA which has helped the bank to reduce their interest cost.

From the total deposits Western province contributes to near 65% where the bank operates 46 branches with average deposit base of LKR1.5 bn per branch. 8 branches in the North & East contributes 5% of to the total where the average deposit base per branch stands near LKR0.8 bn. Going forward with the newly liberated North & East integrated into the main stream economy we expect the contributions from the North & East branches to increase.

Loans

SEYB’s loan growth surged from 2001-2005 at a CAGR of 20.4% mainly backed by the industry wide growth momentum. However we see a notable dip in banks loan growth from 2006-2008 due to contractionary monetary policies adopted by CBSL to curtail inflation coupled with the heightened conflict situation which discouraged new investments.

We saw the industry loan growth slowly recovering from 2008 onwards where as SEYB recorded a 23% dip in its loan book in 2009 which was the largest contraction compared to its peers. This was mainly due to the high proportion of the loans being categorized as non performing loans. (2009 SEYB had the highest NPL ratio of 29.3%) During 1H2010 we saw a marginal dip of 1% in banks net loans due to growth slower private sector credit growth during 1H2010 but we saw an improvement in the NPL position of SEYB in 1H2010. (NPL ratio during 1H2010 stood at 25.6%).

In terms of the sector wise break down we see majority of the loans granted to the housing sector where it contributed for circa 17% of the total loan book whilst consumption sector contributed for 10%. However it is also note worthy that housing and consumption sectors are the sectors that will mostly affect the asset quality.

SEYB is concentrated more on short term loans where it is circa 51% of the total portfolio where as medium term loans contribute 25% and contribution from long term loans stands at 24%. Further SEYB from the inception had more focus on the retail segment (which yield higher margins) and currently operate at a retail : corporate mix of near 70:30. Bank also has seen increasing demand in its pawning business (which is a highly profitable business with low risk) specially from Northern province, where currently pawning contributes for circa 6-7% of the total advances.

Interest Margin

SEYB has been able to enjoy above 5% interest margins during the last five years (even in times of crisis) due to its retail focus and differentiated service. Banks interest margin of 5.5% was in line with the industry average of circa 5%.

Asset Quality

SEYB’s non performing loans (NPL) were at manageable levels (gross NPL ratio near 8%) during 2005-2008 but with reckless lending patterns which resulted in NPL’s to peak up to near LKR30 bn in 2009 whilst the gross NPL ratio for 2009 stood at 29.3% (which was the highest in the industry). However with the emphasis on recovering the bad loans under new management we saw a reduction in NPL’s in 1H2010 which stood at LKR27.5 bn however the gross NPL ratio is still the highest in the industry at 25.6% (industry NPL ratio is circa 8%).

Capital Adequacy

Bank has improved its capital position after it fell below regulatory limits in 2008 where the Tier II CAR stood at 9.4% vs 10% regulatory limit. Bank is comfortable with its current capitalization level (Tier I at 10.6% and Tier II at 12.8% compared to regulatory limits of 5% & 10%). Further Fitch Ratings Lanka Ltd’s rating on SEYB is BBB+ and the outlook is stable.

Financial Performance

SEYB was growing gradually during 2005-2007 where the major set back occurred in 2008 where the group recorded a loss of LKR143.0 mn. It is also noteworthy in 2008 banks operating cost increased exceptionally than its NII largely owing to high provisioning costs. However we saw the bank improving its performance during 2009 under the new management where the bank recorded a profit of LKR569.2 mn (up 498% YoY). Main reason behind improvement in operations was reducing operating costs and provisions despite business volumes were contracted. Further it is also encouraging to see SEYB recording a profit of LKR507.3 mn in 1H2010.

In terms of profitability ratios we saw SEYB maintained the interest margins at circa 5% levels. However average return on equity and average return on assets fell drastically below industry average in 2008 due to poor utilization of shareholder funds and mismanagement of resources. But bank recovered during 2009 which was reflected in its profitability ratios where the bank recorded improved ROAE of 9.4% and ROAA of 1.2% (Still below industry averages) end of 1H2010.

With higher interest rates we see major contribution (89%) from interest income to total income in 2009. However with rates reducing interest income contribution will decline marginally in the coming years. But we see a notable contribution coming from fee based income in 1H2010 where majority of this is through foreign worker remittances (where total remittances grew by near 14% YoY during 2009). Therefore going forward with the expected circa 15% YoY growth in remittances we believe SEYB will also grow their fee based income part through its partnerships with MoneyGram International, XPRESS MONEY and EzRemit.

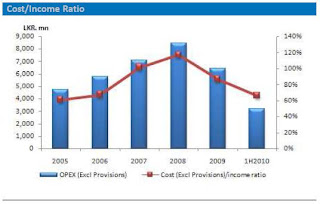

SEYB’s cost to income ratio has been the highest in the industry where it peaked to 117% in 2008 largely owing to higher staff cost. In 2008 bank employed 4,354 employees as compared to 4,041 employed by the largest private commercial bank in the country. Therefore it emphasizes the over staffing problem the bank had over the past hiking up the operating costs. The new management has adopted measures to curtail costs and address the over staffing problem where the bank was able to bring down the cost to income ratio to 66% by 1H2010 (but still was the highest in the industry).

Areas to improve in the future

- SEYB’s cost to income ratio of 66% is the highest in the industry (where industry average is around 55%) and bank also has an overstaffing issue to address (nearly half the size of countries largest private commercial bank in terms of assets but it employees virtually the same number of employees). Going forward tha bank need to address this issue where we have witnessed the bank’s new management have adopted few cost rationalization strategies to reduce cost.

- SEYB’s NPL ratio, ranging from just over 11% to more than 25% since reporting began in 1998. Bank has the highest NPL ratio among its peers and exceedingly high compared with the industry average of 8%. Bank adopted various measures to bring down its NPL’s (execute legal action, stop lending to Ceylinco group etc.) where we saw banks gross NPL ratio improving to circa 25% from a high of 29%.

- Profitability measures such as ROE and ROA fell significantly below the industry norms during the past two years. Therefore the company has to take the challenge of improving the profitability measures in the coming years through its wider reach and improving core business.

Valuation

Forecast 2010E earnings to rise by 78% YoY to LKR1,010.9 mn. With banks promising recovery process where we believe the bank would be able to reduce its NPLs from its current LKR27 bn, adopt necessary measures to curtail cost and improve its core business activities. We also believe SEYB would be in a position to benefit from the expected industry wide upside with strong macro economic position of the country. Based on these assumptions we are expecting a 78% YoY increase in projected 2010E earnings to LKR1,010.9 mn and projected 2011E earnings to rise by 30% to LKR1,316.3 mn.

Non voting share offers good value on 10.9x forecasted 2010E earnings. share has good value on 10.9x (compared to the sector PE of 13.8x) forecasted 2010E earnings and is attractive at 8.1x forecasted 2011E earnings whilst trading on 1.0x PBV. The non voting share which is trading at a near 44% discount to the voting share where the normal discount between the voting and non voting share in the banking sector is 25- 30%. Therefore we believe the gap between SEYB.N and SEYB.X should narrow in the future and given recovery in its core business that we have seen during 1H2010 coupled with the reviving macro economy and growth potential in the banking sector we rate Given the above assumptions on recovery and industry wide upside we rate SEYB (Non Voting) a BUY.

The voting share currently trades at 19.6x projected 2010E earnings and 15.0x on projected 2011E earnings whilst trading on 1.8x PBV. The voting share is trading near 50% premium to the financial sector, However we believe given SEYB’s branch network and reach and the recovery in its core business that we have seen in 1H2010 coupled with the reviving macro economy and growth potential in the banking sector SEYB has further upside, hence we rate SEYB (Voting share) a HOLD.