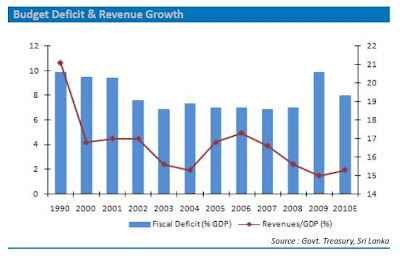

- High current expenditure of LKR879.6bn together with poor revenue collection lead to an overall budget deficit of 476.4bn (9.9% of GDP) in 2009.

- Projected revenue growth for 2010 is somewhat ambitious 15.8% to LKR841.0 bn, with expenses projected to increase by a slower 6.5% largely due to slower escalation in recurrent expenditure.

- With the improvement in projected revenue growth and manageable level of recurrent expenditure government expects the budget deficit as a percentage of GDP to be maintained at 8% (downby 2% YoY). Further deficit is expected to be financed using 28% foreign financing and 72% using domestic borrowings.

- The budget deficit during the first four months of 2010 curtailed at 3.1% as a percentage of GDP.

- The “mini” budget presented did not have any revised revenue proposals and the 2011 budget that will be presented in November 2010 is expected to propose more detailed policy initiatives.

The United Peoples Freedom Alliance (UPFA) government presented its sixth consecutive fiscal budget in parliament on 29th June 2010 for the remaining six months of the year. Further this would be the fifth budget paper presented under the “Mahinda Chinthanaya” programme, following the current President taking up office in 2005.

The 2010 “mini” budget was presented with the wake of IMF’s third tranche of USD407.8 mn being disbursed, which considerably strengthened the government’s coffers. Despite the circa LKR1 bn reduction on expenditure for defense and public security and LKR17 bn reduction on other goods and services mainly due to the drop in such expenditure on national security, the Recurrent Expenses are expected to increase

by 5.5% to LKR928.3 bn mainly due to expected increases in salaries and wages, interest expenditure and subsidies and transfers. The total expenditure is expected to grow by 6.5% to LKR1,279.8 bn whilst total Revenue (excluding grants) is expected to grow at a faster 16.9% to LKR817.8 bn (including grants 15.9% growth to LKR840.9 bn), capping the target deficit at 8.0% of projected GDP. However a 15% plus growth

in revenue could be an uphill task given the current tax regime nevertheless a 24.6% growth seen in the first five months of the year is an assuring factor. Further, Jan-April 2010 has recorded a budget deficit of 3.1% vs 4.1% recorded in the same period in 2009.

The “mini” budget presented did not have any revised revenue proposals and the 2011 budget that will be presented in November 2010 is expected to propose more detailed policy initiatives.

Poor revenue collection and increased spending Divert Deficit target in 2009

IMF deal extended in view of better fiscal management. International Monetary Fund has released funds worth USD407.8mn today which was discontinued following the last year's budget diversion from the expected deficit of 6.5% of GDP to 9.9% due to increased spending and poor revenue collection over the period. The amount was released on the assurance of a more responsible fiscal management for the coming

year. Even though the capital expenditure was 10.9% lower than projected amount , the high current expenditure of LKR879.6bn together with the 10.2% lower revenue lead to an overall budget deficit of 476.4bn (9.9% of GDP) whilst the growth in revenue was circa 5.7%YoY

Revenue targets fell short by 10.2% in 2009. The government has fallen behind its original revenue target of LKR855.0 bn largely owing to slow down in collection of tax revenue which was attributable to the decline in international trade related taxes and reduced domestic economic activities coupled with global economic recession. The high inflationary scenario has had a negative impact on consumption growth, leading to a VAT collection of LKR185.7 bn (lower than the original estimate of LKR221.9 bn). Further the revised value of LKR149.7 bn in 2009 has fallen behind the projected income tax collections of LKR166.7 bn (up 11.4 % YoY).

Recurrent expenditure has overshot target by 6.8% in 2009. The revised recurrent expenses for 2009 was LKR879.6 bn vs the budgeted figure of LKR823.5 bn (up 6.8%) YoY. Increase in salaries & wages, pension payments, interest payments, counter terrorism activities, provision of humanitarian facilities for IDPs and resettlement activities in conflict affected areas drove the recurrent expenses higher than budgeted. Further revised recurrent expenditure as a percentage of GDP stood at 18.2% vs 15.8% which was budgeted in 2009.

Capital expenditure continues to be the scapegoat. Capital spending has been curtailed at LKR330.5 bn (still up 30.9 % YoY), 10.9% lower than the original estimate in 2009. Despite the government's emphasis on infrastructure development, spending on highways and ports following the war have been lower than expected.

Both Domestic and Foreign borrowings to bridged the deficit. Domestic financing contributed 82.2% whilst Foreign financing contributed 17.6% to finance the overall budget deficit of LKR476.4bn. Foreign financing soared to LKR 83.9bn (plus 45% YoY higher than the estimate) whilst the domestic financing dipped by 24.9% YoY to LKR 392.5.6bn (yet 114.3% higher than the forecasted).

Fiscal position to improve in 2010

Revenue projected to grow by 15.9% YoY in 2010. The target of 15.9% YoY growth in revenue to LKR840.9 bn is somewhat ambitious where the total revenue collected for the period Jan-May’10 the has been LKR298.2 bn. The “mini” budget has not proposed any new revenue proposals where the more detailed policy initiatives would be proposed in the 2011 budget Nov 2010. The total revenue is estimated to be generated from LKR729 bn tax revenue and LKR88.8 bn non-tax revenue. Whilst the government

estimates the taxes from external trade to rise 14.0% YoY to LKR145.2 bn, mainly on the back of increase in imports, the Jan-May’10 figures show a 14.2% YoY dip on the back of the Government scaling down certain duties.

Further, the recently proposed tax reforms on imported vehicles, raw materials, electronic goods and etc could also hinder the revenue stream despite the expected increase in the number of items imported. The government expects to meet the revenue target mainly through 14.9% YoY growth in income tax, 20.3% YoY growth in taxes on Goods and services and 14.0% YoY growth in taxes on external trade. Further, the improved domestic economic activities and increase in imports are expected to shoulder the revenue growth.

Total government expenditure for 2010 is estimated at LKR1,279.8 bn. Total government expenditure for 2010 will comprise of LKR928.3 bn (up 5.5% YoY) recurrent expenses and LKR352.5 bn capital expenditure. However the overall government spending for the first four months of 2010 stood at LKR410.9 bn which leaves the government with LKR868.9 bn for the remaining period of 2010.

Recurrent expenditure expected to rise by only 5.5% YoY in 2010. Government expects recurrent expenditure to rise only by 5.5% YoY to LKR928.3 bn in 2010 largely on account of falling inflation levels. However interest cost (which constitutes 36% of recurrent expenditure) is expected to be the main driver of expenditure growth rising 8.9% YoY to LKR337.2 bn in 2010.

Further salaries and wages which accounts for circa 32% of total recurrent expenditure will be increased 9.4% YoY to LKR296.7 bn in the budget 2010. From salaries and wages 47% will be paid to national security and 36% is for education & health.

Subsidies and transfers which account for 22% of recurrent expenditure will be increased 6.7% YoY to LKR202.9 bn whilst pension to public servants would account for nearly 46% of the total subsidy payments.

The total defence and public security expenditure is projected to be at LKR186.3 bn compared to LKR187.2 bn (reduction of mere 0.5%). However we see a considerable reduction in other goods and services estimates from LKR108.5 bn in 2009 to LKR91.5 bn (down 18.6% YoY) largely due to reductions in expenditure on national security.

Further it should be noted that the government has utilized LKR327.0 bn as recurrent expenditure during the first four months of 2010 from the budgeted figure of LKR928.3 bn for 2010.

Capital expenditure is projected to rise by 12.1% YoY in 2010. Government expects a 12.1% YoY rise in capital spending to LKR 361.5bn in 2010 where the main focus is on road development which constitutes 23% of total capital expenditure. Further 10% of non recurrent expenses will be directed towards water & irrigation infrastructure whilst 11% is for the improvement in education & health system in the country. During the period Jan-April 2010 government has only spent LKR89.1 bn from the total budgeted

amount leaving another which leaves them with LKR272.4 bn for development activities for the 2H2010.

Foreign financing to rise in 2010. The government would rely on both foreign and domestic financing to service the planned fiscal deficit of LKR438.8 bn. The government plans to increase its total foreign borrowings by 47.2% YoY to LKR123.5 bn which are largely committed funds. The bulk of the deficit would be financed by domestic borrowing of LKR315.3 bn which would be at a dip of 24.5% YoY. As the proposed budget outturn indicates a reduction in domestic financing by LKR77.1 bn, the government

expects pressure on interest rate to ease which would facilitate credit expansion for private sector development

General benefits of budget 2010

Infrastructure:

Road network: The government has allocated LKR83.4 bn, which is 23% of the total capital expenditure budget for the development of highways. 530 km of rehabilitated national roads, 300 km of rehabilitated provincial roads and 34 new bridges would be added to the road network in 2010. Further, 181 km of express ways, 104 bridges and 1,500 km national roads would be upgraded during the next 3 years.

Port and Aviation: A total of LKR30 bn has been provided for the development of port and aviation facilities where the main projects would be Colombo port expansion, Hambanthota Port development and the construction of the new airport in Maththala.

Irrigation and Water management: It has been proposed to invest LKR37 bn in irrigation and water management systems which include construction of Moragakanda dam and irrigation system, Uma Oya diversion project, Deduru Oya etc. These projects are expected to bring additional area of land under irrigation and convert many lagging districts into economically prosperous areas during next six years.

Terrorist conflict affected areas: A comprehensive medium to long term reconstruction strategy has been planned to transform conflict affected areas into decent living conditions. Funding arrangements are already in place to implement transport, electricity, water, schools, healthcare and all essential facilities in the areas.

Public services:

Health and Education: A total of LKR40.8 bn has been allocated to ensure a quality healthcare system and an education system in the country. Out of that LKR13,300 mn is to be spent on supplying drugs and pharmaceuticals to government health care centers in assuring free healthcare to the nation. Further, a national policy on nursing services will be introduced to improve quality of service whilst indigenous medicine would be popularized as a supplementary health service.

The government proposes to build partnerships with private sector to facilitate students who do not get placement in local universities due to limited openings. This would open more opportunities to the students whilst saving foreign exchange spent on education abroad.

Transport: LKR6,650 mn has been set aside to meet expenditure on subsidized railway and road transportation in 2010.

Water & Electricity: 100,000 new water connections and 250,000 new electricity connections are planned for 2010. This would be augmented to 150,000 water connections and 300,000 electricity connections per year 2011 onwards.

Welfare and social safety: Proposed assistance to the poorer segments of the society, displaced persons, nutritional intervention programs and enhancement of school education exceeds LKR164,000 mn for 2010.

Recent Tax Reforms

There has not been any tax revisions in the mini budget proposed. Following are some recent tax reforms :

- Vehicles : A general 50% reduction of duties on imported vehicles. The tax revision on motor vehicles with effect from 1st June 2010 is as follows :

- Also, an overall removal of 15% surcharge on custom duty, resulting in a four band custom duty structure of 0%, 5%, 15% and 30% was seen with the tariff revision.

- Imported raw materials/ machines and electronic items : A 3% reduction in duty on imported raw materials/ machines to 8% from 11%. Electronic items such as cameras and watches are now prone to a deduction below 10% of overall taxes and are only liable to Port tax levy and Nation Building Tax and not Cess or VAT.

- Wheat Flour : Consequent to the withdrawal of tax concessions on wheat flour, the price of wheat flour increased by LKR10.5 per kg from 22nd June 2010 onwards.

- Sugar, Liquor & Tobacco : Taxation on imported sugar increased by LKR5.0 per kg. Taxes on cigarettes also moved up by LKR1.0 per stick whilst taxes levied on a proof litre of spirits hiked by LKR50.0. These tax impositions came into force from 24th June 2010 onwards.

- Value Added Tax

- Port and Airport Development Levy

0 comments:

Post a Comment