Friday, May 14, 2010

at Friday, May 14, 2010 | 0 comments | banks, research, srilanka

Hatton National Bank (HNB) Net profit down 9% YoY in 1Q2010

Overview

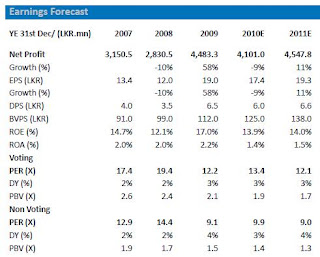

Hatton National Bank’s (HNB) net profit has dipped 9% YoY to LKR649.7 mn in 1Q2010 mainly on the back of 14% increase in non interest expenses and 34% increase in corporate taxes. With the economy expected to grow by circa 6%-7% during the next few years and contributions from the previously war affected North and East to the main stream economy the banking sector outlook remains positive with loan growth expected to gather momentum with the low interest rate environment. HNB’s net interest margins are expected to be intact at around 5%, whilst continuing to benefit from the wider reach facilitated by 187 branches (20 branches in the North and East) and higher retail focus. However, we maintain our forecast 2010 net profit at LKR4,101.0 mn (down 9% YoY)with slower credit growth in 1Q2010 than anticipated coupled with high operating costs and projected 2011 net earnings at LKR4,547.8 mn (up 11% YoY) .

The voting share is trading at 13.4x forecasted 2010E profit and 12.1x on forecasted 2011E whilst trading 1.9x PBV. The non voting share remains attractive on 9.9x forecast 2010 net profit and 9.0x projected 2011E net earnings whilst 1.4x PBV.

Interest income has dipped 14% YoY to LKR7,603.3 mn in 1Q2010. HNB’s interest income has dipped 14.4% YoY to LKR7,603.3 mn in 1Q2010, due to a 22.5% YoY dip in interest income from loans and advances to LKR5,815.6 mn. This is mainly on the back of fall in interest rates and a 3% YoY dip in performing loans to LKR157.3 bn . However interest income from fixed income securities grew 29.1% YoY to LKR1,787.7 mn which was mainly driven by a 5% YoY growth in the Treasury Bill and Bond portfolio (held to maturity) to LKR56.2 bn which is approx. 19% of the banks’ total asset base.

Interest expenses dipped 28% YoY to LKR3,942.3 mn in 1Q2010. Group’s interest expenses have dipped 27.8% YoY to LKR3,942.3 mn in 1Q2010, on the back of 25.1% YoY drop in interest cost on deposits to LKR3,511.3 mn. The drop in deposit cost is largely attributable to low deposit rates and the shift in the deposit mix from high cost time deposits to low cost CASA products. Further interest expenses on other interest bearing liabilities also dipped by 43.9% YoY to LKR431.0 mn.

Net interest income grew 7% YoY to LKR3,661.0 mn. The dip in interest income was off set by a faster decline in interest cost enabling net interest income to grow by 6.9% YoY to LKR3,661.0 during 1Q2010.

Non interest income grew 16% YoY to LKR1,392.8 mn in 1Q2010. Non interest income has grown by 16.2% YoY to LKR1,392.8 mn in 1Q2010 due to 23.4% YoY increase in other income to LKR1,212.1. Other income growth was supported by the capital gain from the sale of a near 20% stake in Lanka

Ventures PLC. Foreign exchange income fell by 16.3% YoY to LKR180.8 mn, due to stagnant exchange rates.

Deposit Mix

Operating cost has increased by 14% YoY in 1Q2010 to LKR3,306.3 mn. Operating costs have risen by 14.4% YoY to LKR3,306.3 mn, mainly due to a 23.4% YoY increase in personnel costs to LKR1,247.4 mn. Increase in personnel cost was a result of salary revision undertaken across all staff grades of the bank during 1Q2010. Consequently the operating cost per branch has mirrored the overall stride in operating cost growth and presently stands at LKR17.7 mn per quarter.

Provisioning cost has dipped 30% YoY to LKR 49.4 mn in 1Q2010. Total provisions have dipped 30.2% YoY to LKR49.4 mn, mainly due to a 78.3% YoY drop in general provisions and 39.1% YoY dip in specific provisions. Gross NPL ratio for HNB is at 7.4% and net NPL ratio stands at 4.1%.

Asset Mix

Total tax bill has risen 10% YoY to LKR1,035.4 mn in 1Q2010. Tax on consolidated profit has increased by 34.4% YoY to LKR563.2 mn pushing up the total tax bill (VAT and Corporate tax) by 10% YoY to LKR1,035.4 mn in 1Q2010 despite 10% YoY dip in value added taxation on banking income. Thus the effective tax rate of the bank is near 60% in 1Q2010.

Net profit down 9% YoY to LKR649.7 mn in 1Q2010. Consequent to a 14% YoY increase in non interest expenses and a 34% YoY increase in tax on consolidated profit has hampered HNB’s profitability during 1Q2010.

Forecast 2010E net profit maintained at LKR4,101.0 mn (Down 9% YoY). With the economy expected to grow by circa 6%-7% during the next few years and contributions from the previously war affected North and East to the main stream economy, the banking sector outlook remains positive where loan growth expected to gather momentum with the low interest rate environment. HNB’s net interest margins are expected to be intact at around 5%, whilst continuing to benefit from the wider reach facilitated by 187 branches (20 branches in the North and East) and higher retail focus. However, we maintain our forecast 2010 net profit at LKR4,101.0 mn (down 9% YoY) with slower credit growth in 1Q2010 than anticipated (private sector credit growth in January 2010 was 0.6% MoM and 1.6% MoM in February 2010) coupled with high operating costs. However we expect 2011 net earnings to grow by 11% YoY to LKR4,547.8 mn on the back of loan book expansion (where the private sector credit is expected to grow from 2H2010 onwards) and cost rationalisation strategies expected to be adopted by the bank .

Share offers good value on 13.4x forecast 2010 net profit. The voting share is trading at 13.4x forecasted 2010E profit and 12.1x on forecasted 2011E whilst trading 1.9x PBV. The non voting share remains attractive on 9.9x forecast 2010 net profit and 9.0x projected 2011E net earnings whilst 1.4x PBV.

Courtesy - Asia Research

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment