Business Profile & Corporate History

Wide ranging business profile. Hatton National Bank PLC (HNB) is Sri Lanka’s second largest private sector bank in terms of assets (behind Commercial Bank of Ceylon) and is the fourth largest amongst all banks (after accounting for the two state banks, Bank of Ceylon and Peoples’ Bank). HNB accounts for 10% of banking system assets and has a network of 186 branches and 266 banking centres (including student centres), which are augmented by 310 Automated Teller Machines (ATMs).

HNB provides a broad range of banking products and services in the areas of;

- Small and Medium Size Enterprise Banking,

- Retail and Consumer Banking,

Further, through a number of subsidiary, joint venture and associate companies, HNB also offers;

- Fixed Income Securities Trading/Investment,

- Venture Capital Financing,

- Life Assurance and General Insurance underwriting and

- Foreign Currency Remittance services.

Entrepreneurial from the inception. HNB’s origins can be traced back to the British colonial era of 1888, when the Hatton Bank was established in the hill country tea plantation town of Hatton (approximately 150 kilometres east of Colombo) by two British entrepreneurs, R.D. Banks and A.T. Atkin. The Hatton Bank was a pioneer of sorts as it was the first regional bank to be set up in the then Ceylon. The bank of course was established to finance the then burgeoning tea plantation industry and also provide deposit services to plantation workers.

In 1948, the Hatton Bank was acquired by another British business house, Brown & Company Limited, which association continued until early 2010. HNB commenced life in its present form in 1970 with the amalgamation of the Hatton Bank with the National & Grindlays Bank Limited’s branches in Kandy (the main hill country city located 110 kilometres northeast of Colombo) and Nuwara-Eliya (the main tea plantation town located 170 kilometres east of Colombo). The amalgamated bank was thus renamed Hatton National Bank and five new branches established simultaneously, raising the total network to eight. In late 1971, HNB made a public offering of shares amounting to 35% of the issued share capital with Brown & Company retaining 38% and National & Grindlays Bank holding 27%.

Rejuvenation in the late 1980s. In the late 1980s, HNB came under the ambit of the privately held Stassens Group, led by the aggressive business leader Harry Stassen Jayawardena, who promptly began to infuse his own unique principles of business aggression and entrepreneurial spirit. Among the key changes that Mr. Jayawardena made at HNB was the recruitment of a new Chief Executive Officer, Mr. Rienzie Wijethilaka, an experienced Sri Lankan banker working in the Middle East. Mr. Wijethilaka was the perfect alter ego to Mr. Jayawardena and together, they brought about a complete attitudinal change at HNB enabling the bank to grow rapidly over the next two decades, despite the overhang of the debilitating northern conflict.

Mr. Wijethilaka’s dynamic leadership at the helm of HNB earned him legendary status in the banking industry in Sri Lanka and even in the South Asian region. He pioneered bank lending to low income entrepreneurs and farmers (positioning the bank maybe just above micro-financing) and was in a sense the Dr. Mohamed Yunus of Sri Lanka. Under his stewardship HNB focused heavily on Retail and Small & Medium Enterprise banking which enabled the bank to grow much faster than its peers that were essentially serving the large and medium sized corporates. More importantly, he groomed a second line of management, who are now steering HNB in the unchartered era of peace. Mr. Wijethilaka is now the non executive Chairman of the Bank, although he still has influence over policy direction.

HNB has been the most adventurous of the commercial banks in Sri Lanka, expanding its product and service offerings to augment the core commercial banking business. Whilst it is acknowledged that HNB (like most other financial services organizations in Sri Lanka) could have done more to expand its ambit of operations, the bank nevertheless has always been on the lookout to venture into related financial services businesses. The HNB umbrella of businesses now comprise of Insurance Underwriting, Investment Banking/Stock Broking, Venture Capital Financing, Property Development/Construction and also Exchange House operations in key Sri Lankan migrant labour markets such as the Middle East and Canada.

HNB’s earliest diversification venture was into stock broking - HDF Securities (Pvt) Limited - in 1992 in association with Jardine Fleming of Hong Kong and DFCC Bank (Sri Lanka’s first development finance institution). However, with Jardine Fleming pulling out in the late 1990s and DFCC setting up its own brokerage house, HNB took full control of HDF Securities in 2000 and renamed it HNB Stock Brokers (Pvt) Limited. The company was subsequently transferred in 2008 to the new investment banking joint venture with DFCC Bank, Acuity Partners (Pvt) Limited and renamed it Acuity Stock Brokers (Pvt) Limited.

Acuity Partners was established in 2007 with the amalgamation of the investment banking divisions of both HNB and DFCC Bank. In addition to Acuity Stock Brokers, Acuity Partners also has a fully owned fixed income securities dealership, Acuity Securities (Pvt) Limited, which has a licence to deal in the primary auctions of Government of Sri Lanka Treasury Bills and Bonds. Lanka Ventures PLC (LVEN), a venture capital financing arm (again jointly owned by DFCC Bank) was also transferred to Acuity Partners in 2009.

However, HNB’s most prominent diversification venture is HNB Assurance PLC (HASU), an insurance underwriter established in 1998. HASU offers both general/casualty insurance and life assurance underwriting products and services and commands a market share of around 5% in the general segment and 3% in life. The company has grown rapidly in recent times, leveraging on HNB’s customer base and brand equity and is set to gain from rising household disposable incomes as economic expansion gathers pace.

HNB incorporated Sithma Development (Pvt) Limited in 1996 to build, own and operate the bank’s head office. The state of the art 35 story building was completed at a cost of Rs. 4 bn in 2000 and is now a profitable venture, although it had a significant impact on the bank’s profitability during construction, due to cost overruns and funding shortfalls.

HNB has also established three Exchange Houses, Delma Exchange LLC in Canada, Delma Exchange LLC in the United Arab Emirates and Majan Exchange LLC in Oman to facilitate foreign currency remittances to Sri Lanka by the expatriate/migrant labour communities in the respective countries.

HNB currently has 189.5 mn Ordinary Shares with Voting Rights in issue. Although no single shareholder directly owns more than the threshold specified by the Banking Act of 15% of equity, it is acknowledged by the market that entities under the influence of the Stassens Group, controlled by Mr. Don Harry Stassen Jayawardena own approximately 30% of the Voting Ordinary Shares of HNB. These companies are reported to be CBD Exports Limited (6.53%), Milford Exports (Ceylon) Limited (6.53%), Stassen Exports Limited (5.66%), Sonetto Holdings Limited (3.59%), Distilleries Company of Sri Lanka PLC (2.53%) and Standard Finance Limited (2.25%). Whilst Brown and Company PLC owned 5.36% of HNB, this was sold off in early 2010 to Government controlled pension funds/financial institutions.

HNB also has 46 mn Non-Voting Ordinary Shares in issue, which were created to augment the bank’s capital without diluting the control of its main shareholders. These shares rank on par with Voting Shares in all respects except for the lack of voting rights.

Importantly, the Central Bank of Sri Lanka has ruled that shareholders - including groups connected to each other - of licenced commercial banks would have to compulsorily adhere to the shareholding thresholds specified by the Bankin Act i.e. a maximum of 15% of equity by 2012. This would broad-base the shareholding structure of HNB and reduces the influence of the Stassens Group, thus bringing about

greater focus on minority shareholders.

Solid senior management team. During Mr. Rienzie Wijethilaka’s tenure of office, a formidable second line of senior management was groomed and readied to take over the reins of the bank. Thus, when Mr. Wijethilaka assumed the mantle of Chairman in 2005, Head of Corporate Banking, Mr. Rajendra Theagarajah effortlessly took up office as Managing Director/Chief Executive Officer of HNB.

Mr. Theagarajah has been with HNB for over 13 years and is a highly regarded professional in the banking industry in Sri Lanka. He is a fellow member of the Chartered Institute of Management Accountants of the United Kingdom and has also earned an M.B.A. from the Cranfield University.

Mr. Theagarajah is assisted by nine Deputy General Managers (DGMs) and ten Assistant General Managers (AGMs), who are well qualified with long years of experience at HNB and in banking industry in Sri Lanka. HNB’s senior management team is also augmented by some thirty five Chief Managers and Senior Managers, who are well qualified in their respective areas of specialization.

Right blend of Entrepreneurial Flair and Conservatism. What stands HNB apart from the rest of the banking industry in Sri Lanka is the entrepreneurial flair of its senior management team. Whilst this orientation has had its pitfalls in the past resulting in relatively higher levels of NPLs, the management has learnt from past mistakes and infused the right blend of conservatism, enabling the bank to grow rapidly with a focus on asset quality. We believe that this new blend of management culture of entrepreneurialism and conservatism has positioned HNB well to gain from the emerging opportunities for growth in the post war era, especially in the northern and eastern provinces of the country.

Effective Risk Management framework. Further, HNB has put in place an effective Risk Management System with clearly stated procedures, utilizing various committees that constitutes senior management personnel with requisite expertise/experience. An Audit Committee comprising of four non-executive directors oversees the overall compliance with regulations with emphasis on audit and inspection functions. HNB also places considerable emphasis on pre-approval credit evaluation which is backed by constant training of credit officers. In addition, the bank has a customer rating system which evaluates the risk profile of all customers at the point of loan application and also on an annual basis.

Awarded ‘Best Corporate Annual Report 2008’. HNB’s commitment to good corporate governance and disclosure was recognized by the Institute of Chartered Accountants of Sri Lanka (ICASL), when in 2008 the bank’s Annual Report was awarded the ‘Gold Medal’ for the ‘Best Presented Annual Report’ in the country. HNB also received the ‘Silver Award’ for the best presentation of ‘Management Discussion and Analysis’ of the business performance of the bank in the same year, reflecting the high quality of financial/corporate reporting.

Competitive Position/Strengths

AA- Credit Rating. HNB has received an AA- credit rating from Fitch Ratings Lanka Limited, Sri Lanka’s main rating agency and a subsidiary of Fitch IBCA of the USA. The rating is a notch below that obtained by state owned Bank of Ceylon and Commercial Bank and reflects the legacy of historically relatively high NPLs. Nevertheless, we believe that HNB has vastly improved its quality of the loan portfolio in 2H2009, which should lead to a rating upgrade in 2H2010. Further, we also think that HNB’s management has learnt from its past mistakes and is now more adept at credit evaluation, approval and monitoring, enabling the bank to continuously improve its asset quality. Obviously, the rating is also an important tool for HNB to raise short/long term funds from the interbank/capital markets at relatively attractive rates.

Euromoney’s “Best Bank”. HNB’s strong market presence in the banking industry was recognized by the highly reputed “Euromoney” Magazine, when in 2009 it was named the “Best Bank in Sri Lanka”. This was a significant achievement for HNB and would be leveraged in its quest to gain market share in the corporate banking segment. Further, the accolade would also stand HNB in good stead in its international dealing/ventures.

Strong Franchise in Retail/Personal and Small & Medium Enterprise (SME) Banking. Relative to its peers, HNB has acquired considerable banking skills in serving the retail/personal and small & medium enterprise segments. This position was recognized internationally when HNB was selected the “Best Retail Bank” in Sri Lanka in 2008 and 2009 at the ‘Asian Banker Excellence in Retail Financial Services Awards’. These skills are expected to stand HNB in good stead in the new era of peace in Sri Lanka as demand for retail/personal and SME banking products and services are expected to far outpace growth of the corporate segment.

Leader in higher margin Retail/Personal and SME Markets. From its inception and more so from the early 1990s, HNB has developed a range of banking products and services to serve retail/personal and SME customers, enabling the bank to be the market leader in these segments. In addition to providing opportunity for faster asset/deposit growth, the retail/personal and SME banking segments also offer higher interest margins, enabling HNB’s profitability to rise rapidly. Over 35% of HNB’s lending portfolio comprises of loans, leases, housing loans, pawning advances (loans backed by gold jewelry) etc. to the retail/personal segment, which proportion we expect to grow sharply in the next five years. In addition, around 45% of HNB’s lending has been to medium sized enterprises.

High level of Marketing skills. In its quest for leadership in retail/personal and SME banking, HNB has acquired/developed strong marketing skills. HNB is also recognized as possessing the best marketing team in the banking industry, having developed highly visible, focused retail/personal banking products and services in deposit mobilization, leasing, pawn broking, housing finance etc. In particular, HNB’s deposit mobilization scheme, “Pathum Vimana” (Wishing Land), with its high value prize draw has been one of the most successful and visible marketing programmes in the country.

Micro Financing Expertise will place bank strongly in Northern and Eastern Provinces. HNB is the pioneer of Micro Financing in Sri Lanka and has acquired considerable expertise in the segment. With the end of the military conflict, it is obvious that enormous opportunity exists to provide Micro Financing services in the northern and eastern provinces in a huge range of industries such as trading, agriculture, fisheries etc. HNB, with its expertise in Micro Financing is strongly placed to capture the lion’s share of this business area, vis-à-vis its peers.

Micro Banking Units to promote “Financial Inclusivity”. To augment its Micro Financing operations, HNB is also setting up Micro Banking units in rural areas. The first of such outlets was established in 2009 in the hill country, offering information technology backed banking and insurance services inclusive of an Automated Teller Machine. HNB’s strategy is to promote “Financial Inclusivity” by setting up Micro Banking units, thus expanding its customer reach and base. Such customers can be nurtured and gradually upgraded to offer a full range of banking products and services.

JV, Acuity Partners to gain from emerging Project/Infrastructure Financing opportunities. Given its relatively large size, HNB has been at the forefront of financing large industrial and infrastructure projects, especially in the areas of apparel and textile manufacture, telecommunications, power generation etc. To better capture the emerging opportunities for project and infrastructure financing, HNB formed Acuity Partners, a joint venture investment bank with DFCC Bank. Whilst Acuity Partners will provide structuring/advisory services in project/infrastructure financing, HNB and DFCC Bank will be lead financiers of such projects.

Strongly placed in Foreign Currency Remittance Market. HNB has also developed a strong presence in the market for remittance of foreign exchange by Sri Lankan expatriate employees working in the Middle East and North America so much so that the bank now has the second largest foreign currency holdings, behind the state owned Bank of Ceylon. Foreign currency holdings also enable the bank to make considerable gains on depreciation of the Sri Lanka Rupee. To facilitate remittances, HNB has also set up exchange houses in Oman, the United Arab Emirates and Canada. HNB also plans to expand remittances services to the Indian subcontinent commencing 2010, which should prove to be highly lucrative.

HNB Assurance to augment core banking business. HNB’s insurance underwriting subsidiary has augmented the core commercial banking operations by providing the bank’s corporate clients with Bancassurance products and services and retail/personal customers with a range of general insurance and life assurance policies. HNB Assurance is now gaining market share strongly underpinned by HNB’s banking presence and is expected to grow rapidly given the low insurance penetration in Sri Lanka.

Extensive reach. Although not a technological leader, HNB has compensated for this by establishing an extensive network of branches, service centres and automated teller machines across the country, barring for the previously war ravaged areas in the northern province. At the end of 2009, HNB had 186 fully fledged branches (all on-line), 310 ATMs, 153 student banking centres and 115 other units that provide various banking/financial services. In addition, HNB also provides internet banking, phone banking and SMS banking services.

Fundamental Outlook

Asset/Loan Growth to Accelerate

Asset/Loan growth of Sri Lanka’s commercial banks has historically tracked expansion in Nominal Gross Domestic Product, as much of business start-up/capacity expansion/project/working capital financing is still done by the banking industry and to a smaller degree by Finance Houses. Disintermediation via the Capital Market for Fixed Income Securities/Corporate Bonds remains only at very marginal levels due to the lack of reach of non-bank/non-finance house intermediaries such as merchant and investment banks, volatile interest rates and low awareness of such products amongst savers.

Against the above backdrop, commercial banks have thrived with little competition, with the two state banks – Bank of Ceylon (BOC) and Peoples’ Bank (PB) – still leading the pack. These two banks still account for approximately 40% of the assets and liabilities of the commercial banking industry in Sri Lanka, although this share is down from around 60% a decade ago. The loss in market share by the two state banks can be attributed to poor lending practices and the resultant capital adequacy constraints. This in turn has limited their lending capacity, with the ultimate gainers in market share being the private sector commercial banks. Further, superior services and products of the private sector commercial banks, underpinned by technology, have also helped institutions such as HNB to grow swiftly in recent times.

In the five years to 2009, HNB’s assets have grown strongly by a compound annual rate of 10.44% to LKR280.6 bn. Asset growth was driven by a similar 9% CAGR in gross loans & advances/bills of exchange/leases (excluding non performing loans) to LKR 167 bn during the period. Although HNB curtailed lending in 2H2008 and 2009 in response to sluggish economic conditions on account of the global credit crisis and the escalation of the northern conflict in Sri Lanka, which caused interest rates to rise sharply, the subsequent fall in lending rates in line with declining benchmark government treasury yields has prompted the bank to shift emphasis to expanding its loans and advances book whilst preserving/enhancing asset quality in order to sustain profit growth.

In 2009, although HNB’s assets grew by 9.3% YoY to LKR280.6 bn, gross loans & advances/bills of exchange/leases declined by 4.5% YoY to LKR 174.2 bn. This was following HNB’s deliberate policy of limiting lending in the stressful economic and high interest rate environment that prevailed during the period. Nevertheless, HNB shifted much of its liquidity during this period into government securities which were yielding rates of nearly 20% in 2H2008 and 1H2009.

Looking ahead, given its healthy liquidity, surplus capital, extensive branch/service centre network, marketing savvy and technology, HNB is well placed to expand its loans & advances/bills of exchange/leases on the inevitable acceleration in economic growth commencing 2H2010, augmented also by a revival in import and export trade. Further, given its substantial resources and ability to mobilise deposits, HNB is likely to focus on big ticket lending in syndication with other banks in financing capacity expansion/new projects/infrastructure development. Consequently, we are projecting HNB’s gross loans & advances/bills of exchange/leases to grow by 22% YoY to LKR 212.6 bn in 2010 and further by 21% YoY to LKR 257 bn in 2011, also gaining market share from rest of the industry. We also forecast HNB’s gross loans & advances/bills of exchange/leases to expand by a CAGR of 21% over the next five years to LKR 454.3 bn by end 2014.

Asset Quality has Improved Vastly

HNB’s aggressive pursuit of growth in the 1990s resulted in a sharp deterioration of its asset quality and a consequent decline in profitability. In 2002, HNB’s Non Performing Loan (NPL) ratio rose to a dizzy 18.9%. However, since then, the bank has put in place an effective credit approval and monitoring process, thus enabling its asset quality to improve vastly. A key aspect of this effort was the better quality and accessibility of information subsequent to the bank integrating its software systems. This has enabled HNB to considerably strengthen monitoring and follow up. Further, HNB’s Credit Risk Management division now enjoys a greater degree of influence and veto power in the loan approval and monitoring process compared to the past but it still falls short of being entirely free of influence from the bank’s various loan origination business units.

HNB’s improvement in risk management has enabled its NPL ratio to decline to 7.16% in 2009 from 7.43% in 2008 despite the very difficult economic and operating environment. However, with global economic recovery and acceleration in economic growth in Sri Lanka, HNB’s NPL ratio is projected to decline to 6.16% in 2010 and fall further to 5.35% in 2011.

Lending Rates to Decline but still be Lucrative

Depending on the type of advance, maturity, security, credit worthiness/relationship of customer, HNB’s average lending rates computed on gross advances vary between 15-22%. While the rates on unauthorised overdrafts can be as high as 24%, negotiated overdraft facilities however usually incur more flexible rates of 18-22%. HNB’s effective lending rate on high margin leases averages around 22%, while pawn broking loans yield a relatively high 24%. However, the bulk of the lending of short and term loans is made at around 18%.

Government Fiscal and Balance of Payments stress together with flight to quality of deposits (following a run on deposits on financial institutions perceived to be unstable) caused interest rates to rise sharply in 2H2008 and 1H2009. However, with the end of the northern conflict in May 2009, a Standby Facility being made available by the International Monetary Fund and sharply lower inflation, interest rates collapsed in 2H2009.

Given the considerable volatility of interest rates in 2008 and 2009, lending rates in the banking industry remained high on an average basis. Consequently, HNB’s yield on interest earning assets rose to 14.06% in 2007 and further to 15.26% in 2008 before easing somewhat to 14.65% in 2009. Looking ahead, although fiscal dominance continues and inflation would likely rise in 2010, interest rates should remain subdued during the year as relatively high monetary liquidity offsets rising demand for credit from the private sector. Consequently, we expect HNB’s yield on interest earning assets to fall further to 13.39% in 2010. In 2011, we expect government fiscal borrowing to ease and inflation to moderate, causing HNB’s yield on interest earning assets to decline further to 12.55%. A similar scenario is likely to prevail from 2012 onwards as faster economic growth should improve government revenue enabling a reduction in the fiscal deficit and interest rates.

Gaining Deposits Market Share

HNB’s considerable marketing skills, high profile deposit mobilization campaigns, and an extensive branch/service centre/ATM network have enabled its deposits to grow by a compound annual rate of 10.42% over the past five years. In 2009, HNB’s deposit base grew by 12.7% YoY to LKR210.3 bn as the bank benefitted from the flight to quality by savers in the face of collapse of several non-bank financial institutions.

We believe that HNB is now poised to significantly increase its deposits market share given its emphasis on retail/personal banking, backed by rapid expansion of its branch and ATM network, introduction of value added savings products. We particularly expect HNB’s plan of expanding its branch and ATM network in the next two years will give the bank a substantial edge in competing for deposits. Consequently, we expect HNB’s deposits to grow by 3% YoY to LKR 216.7 bn in 2010 and further by 17.6% and 23% respectively to LKR 254.8 bn and LKR 313.5 bn respectively in 2011 and 2012.

Cost of Funds to Ease

In line with fluctuation in interest rates as elaborated above, HNB’s cost of funds on interest bearing liabilities rose from 8.51% in 2007 to 9.78% in 2008 before easing to 9.09% in 2009. With the sharp decline in interest rates in 2H2009, we are projecting HNB’s cost of funds on interest bearing liabilities to ease further to 7.37% in 2010 and decline further to 6.26% in 2011 and to 5.32% in 2012.

While the trend in cost of funds on interest bearing liabilities is largely attributed fluctuation in overall interest rates, HNB’s cost of funds has been higher as a result of a shift in its deposit mix. This of course is due to the introduction of a comprehensive range of electronic banking services causing its deposit mix to shift away from current accounts to interest bearing savings and time deposits. While 16% of HNB’s total deposits were in current accounts in 2007, the ratio has declined to 7.72% in 2009. However, we believe that the ratio of current account deposits is unlikely to decline further in the future by any significant degree and therefore curtail upward pressure on funding costs resulting from the deposit mix.

Net Interest Income to rise on higher Interest Spreads

HNB’s interest spreads fell in 2008 to 5.48% from 5.55% in 2007 as the bank’s cost of funds rose faster than its interest yield against the backdrop of significant financial industry systemic stress. This followed the collapse of several non-bank financial institutions associated with a particular business group and the resultant flight to quality by depositors, forcing deposit rates up sharply in 2H2008. However, following the end of the northern conflict and a sharp reduction in inflation, deposit rates declined significantly in 2009. Consequently, HNB’s interest spread rose to 5.56% in 2009.

Combined with higher interest spreads, HNB’s net interest income rose strongly by 29.2% YoY to LKR11.0 bn in 2007 on faster loan growth (+24.3% YoY). However, following lower interest spreads and slower loan growth (+11.2% YoY), HNB’s net interest income increased by a slower 14.1% YoY to LKR2.54 bn in 2008. Whilst HNB’s gross loans contacted by 2.9% YoY in 2009 (as economic activity slowed sharply in 1H2009), the bank shifted much of its surplus funds into high yielding government treasuries, enabling net interest income to rise relatively strongly by 16.1% YoY to LKR14.56 bn.

Going forward, we are projecting HNB’s interest spread to rise to 6.01% in 2010 as the full impact of the decline in deposit rates in 2009 reduces the bank’s cost of funds significantly. Consequently, coupled with faster loan growth (+21.5% YoY), we expect HNB’s net interest income to rise strongly by 21% YoY to LKR17.61 bn in 2010. We are also projecting HNB’s net interest income to rise further by 18.3% YoY to LKR20.84 bn in 2011 and further by 25.7% YoY to LKR26.19 bn in 2012.

Non-Interest Income to grow steadily

Non-interest income has accounted for around 15.3% of total income at HNB over the past three years to 2009, with the main components being foreign exchange (FX) gains and fee/commission income. While the bank does not usually take any trading positions in foreign currency, FX gains generally arise on bills purchased due to SL Rupee depreciation against the US Dollar. In addition, HNB also consolidates revenues of HNB Assurance, the insurance underwriting subsidiary, which are stated under non-interest income. Having grown strongly by 23.2% YoY in 2007 and 22% YoY in 2008, HNB’s non-interest income growth slowed to 10.2% YoY in 2009 (LKR6.48 bn) as economic expansion decelerated and the SL Rupee appreciated.

Looking ahead, we expect more moderate growth in non-interest income of 17.3% YoY to LKR7.6 bn in 2010 and 15.8% YoY to LKR8.81 bn in 2011 due to slower depreciation of the SL Rupee and a gradual recovery in export and import trade.

Cost : Income Ratio to improve

At 56.9% in 2009, HNB’s Cost : Income Ratio (excluding provisions) is among the lowest in the banking industry in Sri Lanka. This is despite considerable expansion in its branch and ATM network over the past five years. HNB’s recent focus on curtailing growth in operating expenses makes it stand apart from the industry and is a reflection of its strategy of delivery of banking services through low cost distribution channels and the effectiveness of management.

Despite the continued expansion of the branch and ATM networks HNB’s Cost : Income Ratio should fall to 54.3% in 2010 on higher growth in overall income. Although the cost of personnel, which accounts for roughly 30% of total overheads is bound to rise in line with overall inflation, we expect other operating expenses to rise at a slightly faster rate. Consequently, we are projecting HNB’score operating expenses to rise by approximately 15% p.a. over the next three years despite easing inflation, enabling the bank’s Operating Profit (before provisions) to grow by 29.3% YoY to LKR11.54 bn in 2010, by 22.3% YoY to LKR14.0 bn in 2011 and by 32.3% YoY to LKR18.32 bn in 2012.

Provisions for Loan Losses to decline

HNB’s provisions for possible credit losses has been around 0.55% of its gross loans&advances/bills of exchange/leases and 8% of NPLs over the past three years. Although the bank’s specific provisions for possible credit losses increased by 8% YoY to LKR729.8 mn in 2009, this was offset by a reversal of LKR21.6 mn in general provisions. HNB’s general provisions in 2008 amounted to LKR483.7 mn and was part of a programme mandated by the Central Bank that required commercial banks to provide an additional 1% of their gross loans&advances/bills of exchange/leases over a period of two and a half years commencing 2007.

Going forward, we expect HNB’s specific provisions for loan losses to fall in 2010 even in absolute terms as economic growth accelerates and the bank’s non-performing loan ratio declines. Consequently, we are projecting specific loan loss provisions to decline by 7.9% YoY to LKR671.9 mn in 2010 but we also expect the bank to make general provisions of LKR62.6 mn. In 2011, we are projecting loan loss provisions (both specific and general) to increase by 6.7% YoY to LKR783.7 m and further by 7.3% YoY to LKR840.9 mn in 2012.

Net Profit to rise by CAGR of 23.5% over next three years

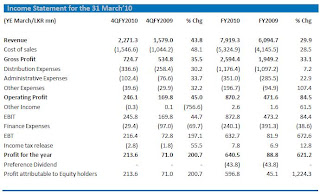

HNB’s Pre-Tax (before VAT and corporate tax) Return on Assets has averaged 2.71% over the past three years. However, following strong growth in profitability in 2009, Pre-Tax Return on Assets reached 3.04% in 2009. In absolute terms, HNB’s Profit before Tax (i.e. Value Added Tax on Financial Services and Corporate and Deferred Tax) rose by 42.8% YoY to LKR5.81 bn in 2007 before slowing to LKR6.28 bn in 2008 (+8.2% YoY) due to higher loan loss provisioning. However, HNB’s Pre-Tax Profit has risen strongly by 33.2% YoY to LKR8.36 bn in 2009 as loan loss provisioning declined.

The effective tax on profits of banks has been very high in Sri Lanka. This followed the imposition of a Value Added Tax (VAT) on banks and financial institutions. As per the law, “Banks and other Financial Sector Organisations are subject to VAT at a rate of 10% commencing 1st January 2003. The base for the calculation of VAT is total net profit and expenditure on employee remuneration inclusive of benefits”. Further, the law states that “No input credit is permitted. In view of the fair method of calculation in that the tax is on net income and wages, it cannot be passed down the system”. Consequently, the effective VAT/Corporate/Deferred Tax rate of HNB has averaged a considerable 48.2% over the past three years.

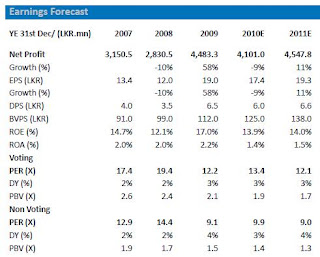

Given the high incidence of taxation on profits, HNB’s Return on Assets has averaged 1.43% in the three years to 2009. In absolute terms, HNB’s net profit has grown strongly by 40.7% YoY to LKR3.15 bn in 2007 before contracting to LKR2.83 bn (-10.2% YoY). However, with the improvement in the net interest margin and lower provisions for loan losses, HNB’s net profit has surged by 58.4% YoY to LKR4.48 bn in 2010.

Looking ahead, given our expectation of higher interest spreads, strong loan growth and easier loan loss provisioning, we are projecting HNB’s net profit to rise sharply by 25.8 % YoY to LKR5.64 bn and grow further by 22.3% YoY to LKR6.9 bn in 2011 and reach LKR9.13 bn in 2012 (+22.3% YoY).

Capital Adequacy well above Statutory Levels

HNB’s Tier 1 and Tier 2 Capital Adequacy Ratios (CARs) are well above the statutory limits specified by the Central Bank of Sri Lanka as per the guidelines of the Bank for International Settlements in Basle. HNB’s Tier 1 CAR in 2009 was pegged at 11.1%, well ahead of the Central Bank specified minimum of 5%. Further, HNB’s Tier 2 CAR in 2009 was at 13.16%, above the statutory limit of 10%. HNB’s relatively high Capital Adequacy i.e. Surplus Capital also means that the bank could sustain loan growth of approximately 25% p.a. over the next three years.

HNB’s stated medium term goal is to maintain its Tier 1 CAR at 9% and the Tier 2 CAR at 12.5%. This would mean that the bank would either drive loan growth aggressively or return surplus capital to shareholders. However, given the likely strong growth in demand for credit over the next five years, it is likely that HNB will opt to grow its Balance Sheet aggressively in order to gain market share. Further, HNB is also likely to use interest bearing long term debt capital in the form of corporate bonds/debentures to funds loan growth.