Tokyo Cement's (TKYO) recorded a net profit of LKR240.5 mn in 1QFY11 (vs a loss of LKR (55.9) mn in1QFY10). TKYO posted strong net earnings on the back of 7.2% YoY growth in the top line, improved gross profit margin and 46.8% YoY dip in finance cost.

The resolution to the national conflict would shape up developments in the North & East and thus TKYO would be able to fulfill the demand with its excess capacity. A marked reduction in the cost base is expected through the synergies of the bio mass plant (LKR200 mn savings) and relatively low interest cost. Against this backdrop we expect TKYO to record LKR839.3 mn in FY11E (up 188%YoY). Further, we believe Tokyo cement is poised for demand driven growth especially in FY12E and we expect a conservative 33% YoY increase in net earnings to post LKR1,112.9 mn.

TKYO (voting) currently trades on 11.9X forecast FY11E net profit, 9.0X projected FY12E net profit and 1.2XPBV. TKYO non-voting currently trades on 8.9X forecast FY11E net profit and 6.7X projected FY12E net profit. We believe the share has strong upside given the positive earnings outlook, on the back of rising demand based on North & East developments, reduction in interest cost and favorable effects of Bio Mass plant. However, due to the fluctuating nature of the earnings exhibited in the past and lack of transparency associates a risk factor with the counter.

Despite the risk of fluctuating earnings exhibited, we continue to place more weightage on the catalysts for growth (greater home building demand, larger construction projects, location advantage and strong brand equity) and as a proxy to the reconstruction drive we believe the counter holds significant upside. Hence we maintain BUY.

Revenue has grown by 7.2% YoY to LKR3,426.0 mn in 1QFY11. TKYO's top line has grown by 7.2% YoY to LKR3,426.0 mn in 1QFY11 which is mainly due to a near 15% YoY growth in sales volume whilst with marginal variances, the price was maintained at circa LKR730/bag (maximum retail price is circa LKR785/50kg bag).

Operating at a near 65% production capacity (total capacity of 1.8 mn metric tons)complemented by an additional 600,000 MT bagging plant, TKYO is positioned to strengthen its revenue base in the future given the increase in demand.

Gross profit increased by 81.6% YoY to LKR825.8 mn in 1QFY11. Despite the increase in the top line the cost of sales has dipped by 5.1% YoY mainly on the back of relatively lower price of clinker, hence the gross profit has grown by 81.6% YoY during the quarter to post LKR825.8 mn. TKYO’s gross margins have strengthened significantly from 14.2% in 1QFY10 to 24.1% in 1QFY11 backed by strong growth in the top line and the dip in cost of sales.

EBITDA has increased by 43.5% YoY to LKR620.3 mn in 1QFY11. The operating expenses have risen sharply during the quarter (LKR620.3 mn in 1QFY11 vs LKR432.3 mn in 1QFY10) mainly on the back of the Nation Building Tax (3% of Turnover) being charged under the expenses.

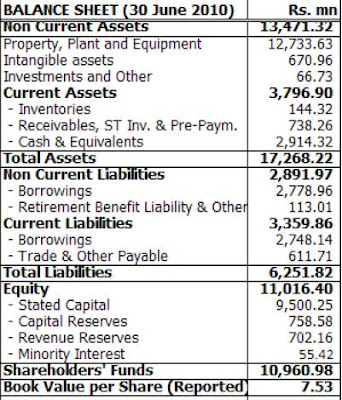

PBT has increased by three fold YoY to LKR240.4 mn in 1QFY11. The finance cost during the quarter has dipped 46.8% YoY to LKR146.3 mn on the back of reduced borrowings (23% YoY dip to LKR1,663.0 mn) and lower interest rates (to a near 8.8% from 12.7% an year ago). Further, during 1QFY11 the depreciation cost dipped by 7.6%YoY to LKR233.6 mn. Subsequently, the PBT grew by near three fold to LKR240.4 mn during 1QFY11.

Net profit has grown to LKR240.5 mn in 1QFY11 vs. LKR (55.9) mn in 1QFY11. During the quarter under review TKYO has posted an impressive LKR240.5 mn in net earnings vs. a loss of LKR55.9 mn in 1QFY10.

Expected Growth and developments in the North & East. Following the entirely resolved terrorist conflict, demand is expected to grow (where the growth potential is signaled in this quarter under review) with the new infrastructure and highway developments in the North and developments could be expected to shape up in the rural areas particularly in the North & East. With 1.8 mn MT capacity and at the present 65% utilization levels, TKYO is positioned to exploit the business opportunities in the North & East as it arises.

Due to location advantage and the involvement with the Japanese owners (Nippon Coke Engineering Co, Japan and St Anthony’s Consolidated Ltd owns 27.5% each) bulk of the development projects in the Eastern province could be awarded to TKYO cement. However, the benefits would kick in based on the speed of infrastructure developments whilst we believe that the present excess capacity of the Trincomalee plant will be utilized to cater for the demand created through the East development contracts thereby contributing towards strong earnings growth in the future.

Power generated through the bio mass plant. The new bio mass plant of TKYO currently generates 10MW where as the power requirement to facilitate their internal requirement is circa 7.5MW whilst the company supplies the surplus to the national grid. This facility is expected to generate cost savings of around LKR200 mn from FY11 onwards. Further, the company incorporated a wholly owned subsidiary “Tokyo Cement Power (Lanka) Ltd” during early this year for setting up and operating of power generation, giving an indication that the company would look for more power projects in the future.

FY11E net profit to reach LKR839.3 mn, up 188% YoY. The resolution to the national conflict would shape up developments in the North & East and thus TKYO would be able to fulfill the demand with its excess capacity. A marked reduction in the cost base is expected through the synergies of the bio mass plant (LKR200 mn savings) and relatively low interest cost. Against this backdrop we expect TKYO to record LKR839.3 mn in FY11E (up 188%YoY). Further, we believe Tokyo cement is poised for demand driven growth especially in FY12E and we expect a conservative 33% YoY increase in net earnings to post LKR1,112.9 mn.

Share offers significant value. TKYO (voting) currently trades on 11.9X forecast FY11E net profit, 9.0X projected FY12E net profit and 1.2XPBV. TKYO non-voting currently trades on 8.9X forecast FY11E net profit and 6.7X projected FY12E net profit. We believe the share has strong upside given the positive earnings outlook, on the back of rising demand based on North & East developments, reduction in interest cost and favorable effects of Bio Mass plant.

However, due to the fluctuating nature of the earnings exhibited in the past and lack of transparency associates a risk factor with the counter. Despite the risk of fluctuating earnings exhibited, we continue to place more weightage on the catalysts for growth (greater home building demand, larger construction projects, location advantage and strong brand equity) and as a proxy to the reconstruction drive we believe the counter holds significant upside. Hence we maintain BUY.